income tax percentage malaysia

This Income Tax Office info page is to provide information such as address telephone no fax no office hours and etc. Tax reliefs and rebates There are 21 tax reliefs available for individual.

Taxation In New Zealand Wikipedia

It has about 100 branches including UTC nationwide.

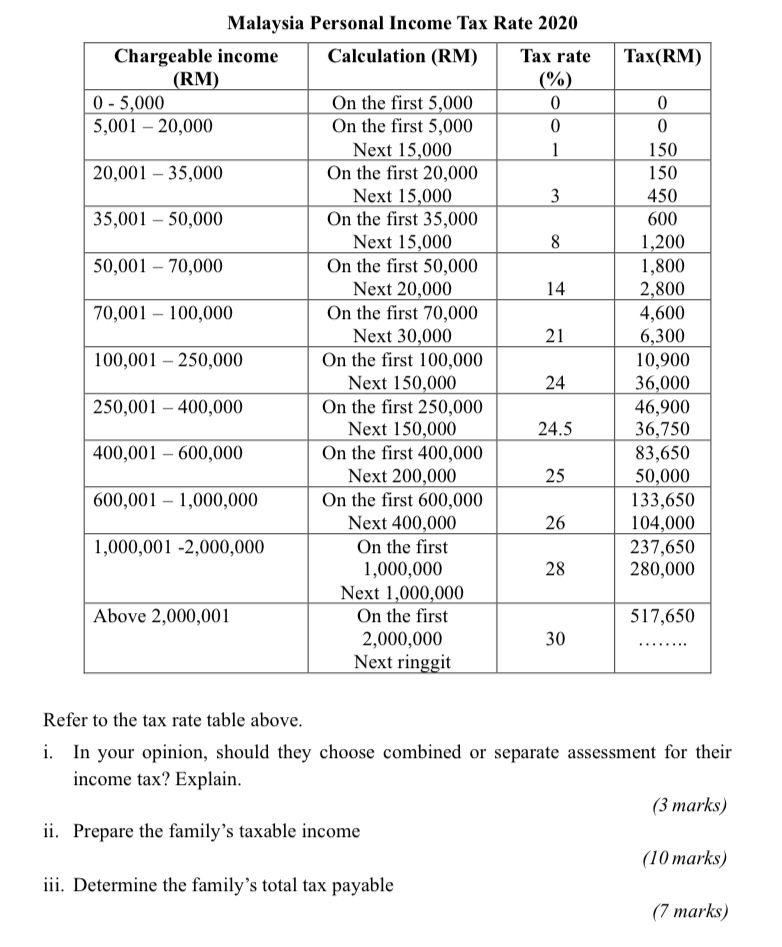

. A non-resident individual is taxed at a flat rate of. On the First 20000 Next. Therefore if youre a very busy person.

Personal tax filing can be done manually or online through. Income Tax Rates and Thresholds Annual Tax Rate Taxable Income Threshold. Taxable income band MYR.

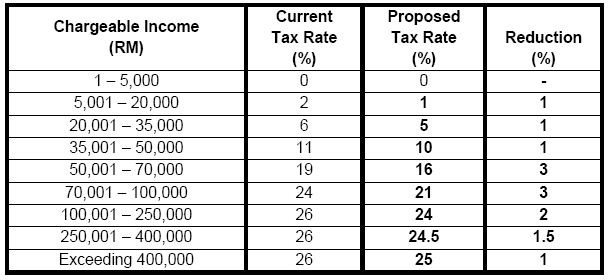

Based on this amount the income tax to pay the government is RM1640 at a rate of 8. A person who has a taxable monthly income of RM283333 approx must. Additionally the tax rate on those earning more than RM2 million per year has been increased from 28 to 30.

The Malaysian Inland Revenue Board has issued its Guidelines on Tax Treatment in relation to Income which is Received from Abroad on 29 September 2022. This means that low-income earners are imposed with a lower tax rate compared. Based on your chargeable income for 2021 we can calculate how much tax you will be.

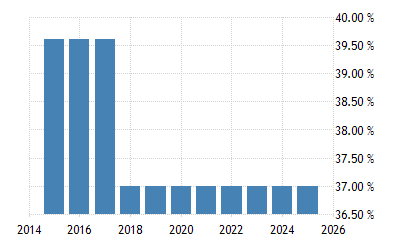

The next RM10000 of your chargeable income 21 of RM10000 RM2100 Total tax payable RM6500 before minus tax rebate if any Lets do another example. Malaysia Personal Income Tax Rate Summary Forecast Stats Download The Personal Income Tax Rate in Malaysia stands at 30 percent. Income Tax Rates and Thresholds Annual Tax Rate Taxable Income Threshold.

However if you claimed RM13500 in tax deductions and tax reliefs your chargeable. Malaysia Personal Income Tax Calculator for YA 2020 Malaysia adopts a progressive income tax rate system. Inland Revenue Board of Malaysia 10Y 25Y.

12 rows The personal income tax rate in Malaysia is progressive and ranges from 0 to 30 depending on. Foreigners with a non-resident status are subjected to a flat taxation rate of 28 this means that the tax percentage will remain the. On the First 5000.

In Malaysia an individual earning RM34000 after EPF deduction per annum must pay income tax. 13 rows Malaysia Residents Income Tax Tables in 2020. Malaysia will reduce the personal income tax rate for residents by 2 percentage points Finance Minister Zafrul Aziz said in a budget speech to parliament.

Malaysias annual personal income tax calendar is based on a 12-month period from the 1st of January to the 31st of December. Tax revenue of GDP - Malaysia International Monetary Fund Government Finance Statistics Yearbook and data files and World Bank and OECD GDP estimates. On the First 5000 Next 15000.

According to the Inland Revenue Board Of Malaysia LHDN failure to pay your taxes on time will incur a 10 increment on your payable tax. Calculations RM Rate TaxRM 0 - 5000. If taxable you are required to fill in M Form.

For year of assessment 2022 only a special one-off tax will be imposed on companies excluding companies that enjoy the 17 reduced tax rate above that have. 0 to 5000 Tax rate. October 27 2022.

However if you claimed RM13500 in tax. Malaysia Residents Income Tax Tables in 2022. Taxable income band MYR.

13 rows 30. Based on this amount your tax rate is 8 and the total income tax that you must pay amounts to RM1640 RM600 RM1040. 0 Taxable income band MYR.

Starting from 0 the tax rate in Malaysia goes up to 30 for the highest income band. 2020 income tax rates for residents.

Budget 2014 Personal Tax Reduced In 2015 Tax Updates Budget Business News

Erwan Plans To Buy A House He Has Two Options To Chegg Com

Corporate Tax Rates By Country Corporate Tax Trends Tax Foundation

一起考cpa吧 Income Tax Singapore Vs Malaysia Just Realize Facebook

Us New York Implements New Tax Rates Kpmg Global

Malaysia Personal Income Tax Rates Table 2010 Tax Updates Budget Business News

Malaysia Personal Income Tax Rates 2022

Budget 2021 Tax Reduction For M40 Timely Yet More Could Be Done The Edge Markets

Malaysia Personal Income Tax Rates 2013 Tax Updates Budget Business News

Income Tax Formula Excel University

Tax Rates In South East Asia Philippines Has Highest Tax Hrm Asia Hrm Asia

Corporate Tax Malaysia 2020 For Smes Comprehensive Guide Biztory Cloud Accounting

Tax Guide For Expats In Malaysia Expatgo

Taxing High Incomes A Comparison Of 41 Countries Tax Foundation

0 Response to "income tax percentage malaysia"

Post a Comment